The Subscription Retention Blueprint: How DTC Brands Are Rebuilding Loyalty in 2025

It’s mid-2025, and a lot of DTC brands are learning the hard way: subscription success isn’t about signing customers up. It’s about getting them to stay.

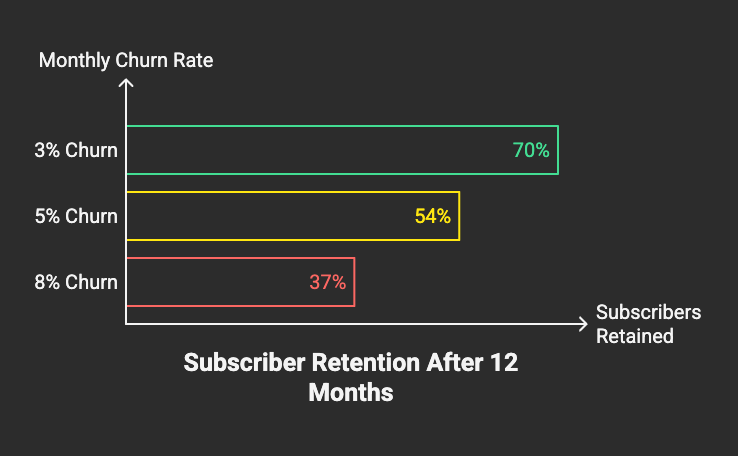

According to Chargebee, 42% of B2C subscription companies are seeing churn rates above 3% per month, and 16% are pushing past 4% (UPI). That’s a major red flag. Because even at 5% monthly churn, you’ve lost nearly half your subscribers within a year.

Factor in summer churn—vacation drop-offs, travel pauses, product overload—and it’s no wonder operators are rethinking everything. Some brands are quietly walking away from subscriptions entirely (BlueTuskr). But the ones staying in the game? They’re rebuilding smarter.

Why Customers Are Really Cancelling

Consumers aren’t just cutting subscriptions for budget reasons (though that’s part of it). The bigger issue is value mismatch. If it feels inflexible, irrelevant, or just like a charge they forgot about—they’ll cancel.

Here’s what the latest benchmarks show:

| Reason for Churn | % of Subscribers Citing It |

|---|---|

| Too expensive | 33% |

| Not using the product enough | 27% |

| Forgot I was subscribed | 18% |

| Couldn't skip/pause easily | 12% |

| Bad customer experience | 10% |

In other words, people don’t want more subscriptions. They want more control.

As one operator said on LinkedIn: “CAC is up, churn is brutal, and consumers are tired of being locked in.” That’s not a signal to panic. It’s a signal to evolve.

1. Flexibility Isn’t a Nice-to-Have—It’s the Model

Subscriptions that let users pause, skip, or downgrade are outperforming those that don't.

- Hims & Hers added a “pause” option. 25% of users who would’ve cancelled paused instead (BusinessWire).

- Recurly data shows 20% of new signups are returning users—often those who paused before coming back.

- 46% of consumers say they’d be more likely to stay if they could downshift to a cheaper or slower cadence (11:FS).

Letting subscribers take a break keeps them in your ecosystem. And if your cancel flow doesn’t offer those options clearly, you’re leaking LTV.

This is where a tool like LiveRecover can reinforce flexibility with a human touch. Brands using LiveRecover’s P2P SMS have seen success in re-engaging subscribers mid-cancel by offering options like “Want to pause for summer travel?”—versus letting them ghost entirely.

2. Don’t Sell a Box—Sell Membership

The best-performing subscription brands aren’t just sending product. They’re building memberships.

| Brand | What They Offer | Result |

|---|---|---|

| MeUndies | Monthly product + 30% off everything | Stickier retention |

| Sip Tequila | $199/quarter for rare bottles + member exclusives | Higher LTV, lower churn |

| BarkBox | Personalized “Super Chewer” club tiers | +15% retention lift in 2024 |

Eli Weiss put it best: “A subscription should feel like joining a VIP club, not getting stuck in a billing trap.” (Eli Weiss)

Tactically, that means layering in:

- Free shipping

- Member-only SKUs or early access

- Loyalty perks (site-wide discounts, reward points)

- Exclusive content, forums, or community drops

When customers feel like they’re getting more than they’re paying for, they stick around.

3. Personalization Is the Stickiness Multiplier

Every subscription box that looks the same as last month? Risk.

The best DTC subs in 2025 are leaning into dynamic personalization—starting with onboarding quizzes and expanding into AI-driven recommendations.

- BarkBox’s personalized boxes boosted retention by 15%

- FabFitFun combines customization with “surprise and delight” moments

- Emerging brands are using quiz data and behavior tracking to flag when a skip or custom send makes more sense

The goal isn’t just tailoring product. It’s making the customer feel seen.

For brands managing this at scale, predictive personalization is becoming table stakes. And for brands that haven’t invested in a customer insights loop? Expect your churn to keep climbing.

4. Don’t Let Churn Catch You Off Guard

Too many DTC brands treat churn like a post-mortem. The smart ones are building early-warning systems.

Here’s what they’re doing:

- Tracking engagement signals (missed logins, skipped emails, failed deliveries)

- Triggering save flows before cancellation clicks

- Running winback sequences based on customer behavior (not just timing)

- Fixing involuntary churn with better dunning, SMS card updates, and account nudges

One underused tactic: integrating LiveRecover SMS for post-cancel follow-up. A real human texting to ask, “Was it too much product? Want us to switch you to bi-monthly?” can outperform even the best automation.

Also: make cancellation easy. It builds trust. And brands with transparent flows consistently report lower net churn than those who hide the off-ramp (WebToffee).

5. What to Do This Quarter

Q3 is the shakeout. If you haven’t updated your subscription program since 2022, here’s your to-do list:

- Audit your cancel flow. Can users pause, skip, or downgrade?

- Layer in value-adds. Membership tiers, VIP perks, access—not just product.

- Mine your churn data. What’s driving drop-off, and can you fix it?

- Test real save offers. But only after you’ve solved experience friction.

- Add LiveRecover (or a human layer) to your SMS stack. P2P retention saves are underused.

Retention is the new CAC. And the brands treating it that way are already pulling ahead.

Subscribe for weekly DTC insights.