The Mobile App Comeback: Why Shopify Brands Are Betting Big in 2025

The “your customers won’t download it” era of branded apps is over.

In the past week alone, multiple Shopify operators have shared wins from rolling out mobile apps—not just to look more polished, but to unlock free push messaging, simplify reorders, and drive loyalty on autopilot.

One founder summed it up:

“Push notifications are the strongest weapon in our arsenal” (Tapcart).

With over 70% of Shopify checkouts now happening on mobile (eCommerce Fastlane), and SMS/email retention costs climbing fast, a native app has gone from “maybe one day” to a high-ROI Q3 priority.

Higher Conversions. Smarter Repeats. More Control.

Apps outperform mobile web across the board:

- Up to 157% higher conversion rates vs. mobile browsers

- 25–35% higher repeat purchase rates

- 1–click reorders, saved payments, and lightning-fast checkout UX

(eCommerce Fastlane)

Obvi, for example, saw its conversion rate double and AOV rise ~15% after launching its app. Within months, app sales made up 21.8% of total revenue (Tapcart).

The Oodie? Even bigger swing: 135% higher conversion and 37% higher AOV through app vs. site (Tapcart).

What’s driving the lift? Two big factors:

- Frictionless checkout (saved logins, payment, face ID)

- Push notifications that outperform email/SMS—and cost $0 to send

Push Notifications > Everything Else

Push is the new retention channel of choice. Tapcart reports average push open rates of 50–90% and click-throughs in the 20–30% range (Tapcart). Compare that to:

- Email: 15–20% opens, 2–3% CTR

- SMS: High open, but 5% CTR and escalating costs ($0.05 per message)

Apps let you bypass inboxes, avoid ad fatigue, and own a direct line to your best customers—for free.

During BFCM 2024, Tapcart-powered brands sent 27M push notifications, helping drive $101.4M in app revenue, up 55% YoY (Tapcart).

“But What If No One Downloads It?”

You don’t need mass adoption to win—just the right segment.

One hobby retailer saw only 10% of customers install the app, but those users now drive 40% of revenue (MobiLoud).

App users are typically your highest-LTV cohort. Apparel brands report 7× higher LTV from app shoppers than web (MobiLoud).

To drive installs, operators are offering:

- App-only exclusives or early product drops

- First-order discounts for app purchases

- QR codes on packaging + website banners

- “Unlock VIP content” hooks in email/SMS

Obvi’s tactic? They tease unreleased products in their Facebook group—then say: “If you want to see it, it’s in the app” (Tapcart).

What Makes a DTC App Actually Work?

The best DTC apps aren’t clones of mobile sites. They feel stickier, more rewarding, and more personal.

Winning features include:

- Segmented push for product drops, loyalty reminders, and post-purchase nudges

- App-only perks (free shipping, VIP access, badges)

- Loyalty dashboards with point tracking and gamified rewards

- Content hubs with recipes, workouts, UGC galleries

- In-app support and subscription management

- And most importantly: a fast, native, bug-free UX

Obvi’s app includes a blog, recipe feed, and wellness reminders (“💧 Don’t forget water today!”). Customers use it even when they’re not buying (Tapcart).

Brands like Princess Polly have hit 98% app user retention by making the app the VIP front door to the brand (Tapcart).

Cost Breakdown: Way Cheaper Than You Think

Forget $100K dev builds. In 2025, most Shopify brands are spinning up apps through platforms like Tapcart for $200–$1,500/month depending on complexity (HulkApps).

That monthly spend:

- Covers app infra + unlimited push

- Pays for itself through repeat order lift and reduced SMS spend

- Takes weeks, not months, to launch

The buildout cost? Often on par with your Klaviyo bill—and it reaches your best customers even more directly.

Real Results, Fast Payback

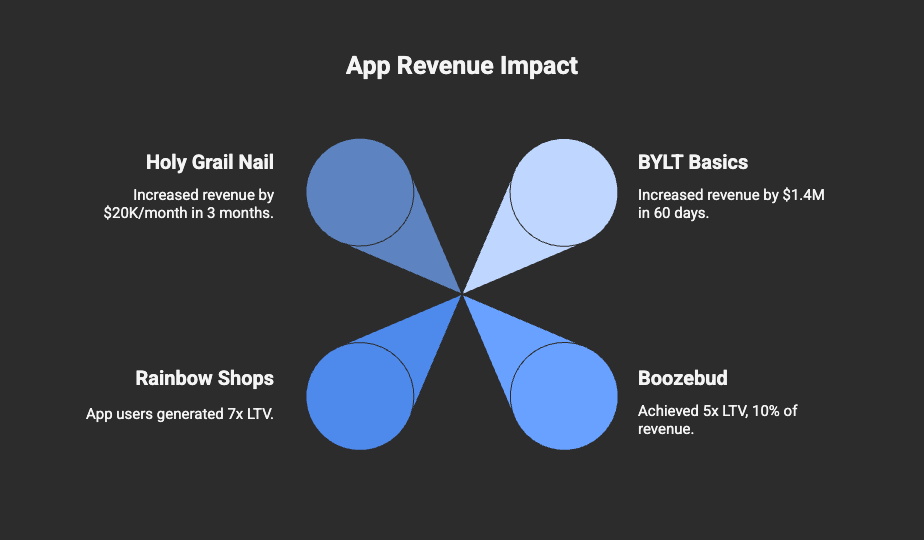

- BYLT Basics drove $1.4M in incremental revenue in 60 days post-app launch (Tapcart)

- Boozebud saw a 5× LTV lift and now gets 10% of revenue from its app (MobiLoud)

- Rainbow Shops' app users have 7× higher LTV and contribute 10%+ of DTC revenue (MobiLoud)

- Holy Grail Nail added $20K/month within 3 months of app launch (MobiLoud)

And that’s not including the SMS spend they’re saving with push.

Bottom Line: Your Best Customers Want the App

A branded mobile app gives you:

- A direct line to high-LTV customers

- A zero-CAC channel with push

- More repeat revenue with less friction

- Community, content, loyalty—all in one place

Shopify's ecosystem makes it easier than ever to build. Your competitors are already reaping the benefits. And if you're still relying solely on email and SMS for retention, you’re leaving money (and margin) on the table.

Subscribe for weekly DTC insights.