Tariffs Surge, DTC Supply Chains Shudder in 2025

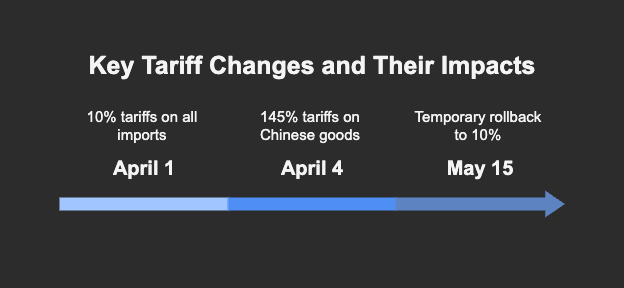

In April, a tariff tsunami slammed global supply chains. The U.S. dropped a sweeping 10% tariff on most imports—then followed with a jaw-dropping 145% rate on Chinese goods just days later (China Briefing, 2025). For DTC brands, the impact was immediate: China-to-U.S. cargo volumes plunged by up to 60%, and founders were forced into rapid-fire adaptation mode (Stord, 2025).

Some are now turning chaos into strategy—reshaping sourcing, pricing transparently, and tightening ops for the long haul.

April’s Shock Tariff Wave

April 2025 didn’t just shift the trade landscape—it detonated it.

A baseline 10% tariff hit nearly all U.S. imports, followed by an additional 125% tariff on Chinese goods, totaling 145% (China Briefing, 2025). The fallout? Shipments from China cratered, with port volumes dropping by as much as 60% in weeks (Stord, 2025).

In May, a temporary 90-day tariff rollback to 10% offered brief relief. Brands scrambled to front-load inventory, racing the clock before duties surged again (Stord, 2025).

Founders Face Pressure—and Get Scrappy

Tariff shock sparked more than just logistics delays—it triggered existential questions. A Passport survey cited by Gaurav Mehta found that 81% of eCommerce leaders now view tariff volatility as a serious blocker to global growth.

But crisis breeds clarity. Faced with ballooning costs and unstable timelines, founders have pivoted fast—tightening operations, reassessing suppliers, and building playbooks for resilience.

How Hydros Saw It Coming

Take Hydros, the DTC water filtration brand that bet early on tariff disruption. Founder Winston Ibrahim stockpiled a full year’s inventory ahead of the hikes—buying time and pricing stability (Retail Brew, 2025).

Even better? He trimmed SKUs, slashing complexity while keeping margins intact. When the 90-day reprieve dropped, Hydros leaned in—accelerating promotions around Prime Day and back-to-school while doubling down on customer retention instead of paid acquisition (Retail Brew, 2025).

Smart Moves from DTC Operators

Here’s what we’re seeing from savvy brands navigating tariff chaos:

- Pricing Transparency: Brands that name-drop tariffs in customer comms see more understanding, not less. One Retail Brew report found 91% of consumers appreciate knowing why prices go up.

- Supplier Diversification: DTCs are fleeing China-dependence, turning to Vietnam, India, Mexico—or even reshoring to the U.S. The goal? Optionality.

- Inventory Timing: Smart founders are mapping tariff windows, ordering big when duties dip, and delaying restocks when rates spike.

- Retention Tools over Discounts: With margins under pressure, tools like LiveRecover are gaining traction. Human-powered SMS win-backs reduce the need for blanket discounting—protecting profit in high-cost moments.

Operational Muscle > Panic Mode

If Q2 proved anything, it’s this: resilience is the new growth hack.

Founders that moved fast—on sourcing, messaging, and margin defense—are coming out of this tariff storm stronger. They’ve built inventory buffers, consumer trust, and teams that can handle volatility.

And in a world where supply chain disruption is more when than if, that’s the playbook you want to be running.

Subscribe for weekly DTC insights straight to your inbox.