Glossier’s Reboot: Inside the DTC Beauty Icon’s Next Phase

Glossier, once the crown jewel of DTC beauty, just announced another pivot: CEO Kyle Leahy is stepping down, with founder Emily Weiss back in the mix to help find her replacement. The move comes days after Glossier expanded its fragrance line and declared it’s entering a “new phase of growth” (Retail Dive).

The headline? Glossier is now profitable. And with retail sales hitting nearly $300 million in 2023—driven by Sephora distribution and a replatform to Shopify—it’s clear the brand has learned from its earlier missteps (Fast Company ME).

But what does this reboot mean for other DTC operators? A lot. Because Glossier’s journey—from cult status to near-collapse to omnichannel comeback—might be the clearest roadmap we’ve got for what it takes to evolve past DTC 1.0.

From Blog to Billion-Dollar Brand

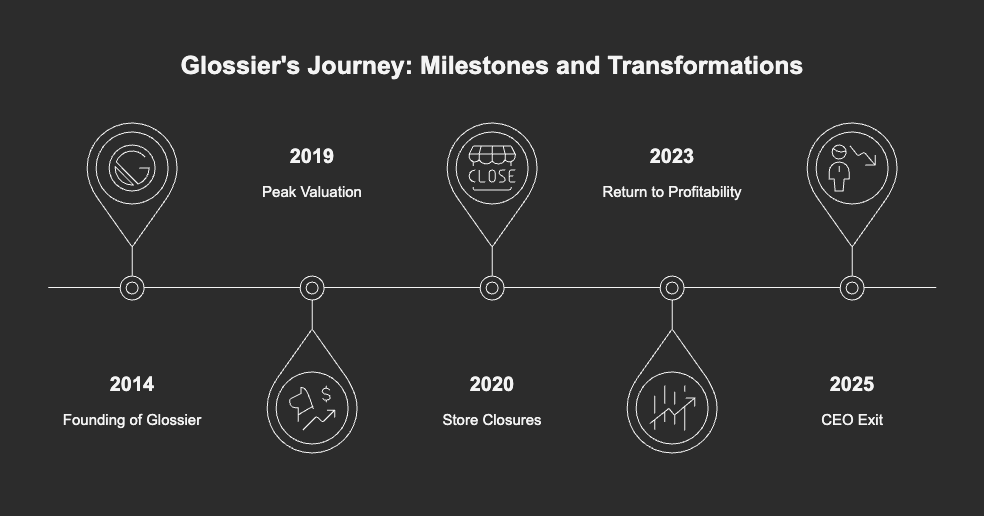

Glossier started as a blog. In 2014, Emily Weiss spun Into The Gloss into a product line powered by community input. The first four products launched with a now-famous blend of relatability, minimalism, and pastel branding that defined the “no-makeup makeup” era (BeautyMatter).

By 2016, Glossier was growing 600% year-over-year. The brand’s flagship product, Boy Brow, hit a 10,000-person waitlist. Its Soho showroom had fans lining up for hours—and it wasn’t just about the product. It was an experience built for Instagram.

The hype translated into numbers: $100M+ in revenue by 2019, $266M raised, and a $1.8B valuation at its peak (Headwest Guide).

The Cool Wore Off

By 2020, things started slipping. Glossier launched too many stores too fast, only to shut them down during COVID. The brand built an expensive in-house tech stack that underdelivered. Internally, it faced public criticism over DEI issues. And Glossier Play, its color cosmetics spinoff, flopped.

Weiss later admitted: “We prioritized strategic projects that distracted us from the laser-focus we needed on our core business” (BeautyMatter).

Meanwhile, competitors like Fenty and Rare Beauty scaled quickly with better shade ranges, celebrity firepower, and retail reach. Glossier, still DTC-only, started to look insular.

The Turnaround: Sephora, Shopify, and Simplicity

In 2022, Weiss stepped down as CEO. She tapped Kyle Leahy—ex-Cole Haan and Nike—to lead the brand out of its operational mess and into its next phase (Retail Dive).

First order of business: Glossier went wholesale. Sephora became its retail partner in early 2023. In year one alone, Glossier generated $100M+ in Sephora sales (Fast Company ME).

The brand also replatformed to Shopify Plus, moving away from its custom stack—a decision that gave the team more flexibility to iterate on CX and product drops (Exhibea).

| 2021 | 2023 |

|---|---|

| DTC-only | DTC + Sephora, Mecca, Space NK |

| Custom tech stack | Shopify Plus |

| $200M (est.) revenue | $300M retail sales |

| Burn-heavy VC growth | Profitability achieved |

Glossier also reopened stores—but slowly. As of 2025, it has around 10–11 permanent retail locations and 650+ Sephora doors. The playbook: omnichannel, not DTC purism.

Product Focus and Brand Equity

With distribution fixed, Glossier refocused on what made it special: good product, launched the right way.

- Glossier You, its fragrance, became a $100M+ hit

- Glossier Deodorant had a 20,000-person waitlist

- The brand now drops something new every 4–6 weeks to keep buzz up (BeautyMatter)

Even its TikTok traction came back. After hitting Sephora shelves, the hashtag #Glossier tripled in views. CMO Kleo Mack summed it up best: “Glossier is bigger than it’s ever been—and that’s a testament to our team knowing how to move fast and stay true to what fans love.” (BeautyMatter)

A CEO Exit—and IPO Talk?

So why is Leahy stepping down now?

Some read it as mission accomplished. Leahy stabilized the brand, scaled smart, and returned Glossier to profitability. Others think this sets the stage for an IPO or acquisition—especially since reports suggest Glossier explored raising $100M earlier this year at a valuation below $1B (TechCrunch).

Weiss, still chair of the board, is leading the search for a new CEO. Whoever takes the reins will need to balance the brand’s founder-led ethos with the operational chops to scale internationally and expand retail even further.

As Weiss put it, the goal is simple: “Build a modern legacy brand.”

What DTC Founders Can Learn from Glossier

- DTC isn’t a religion. Glossier’s refusal to go wholesale hurt them—until they stopped fighting what customers wanted.

- Don’t build what you can buy. Replatforming to Shopify freed them from costly tech distractions.

- Focus wins. Every misstep—from Play to internal software—came from doing too much, too fast.

- Brand still matters. Even after stumbles, Glossier’s fanbase didn’t disappear—they just needed a reason to come back.

- Profitability is cool again. Especially if you’re prepping for the public markets.

Subscribe for weekly DTC insights.