Functional Shots Boom: A New DTC Wellness Trend to Watch

Tiny bottles, big momentum.

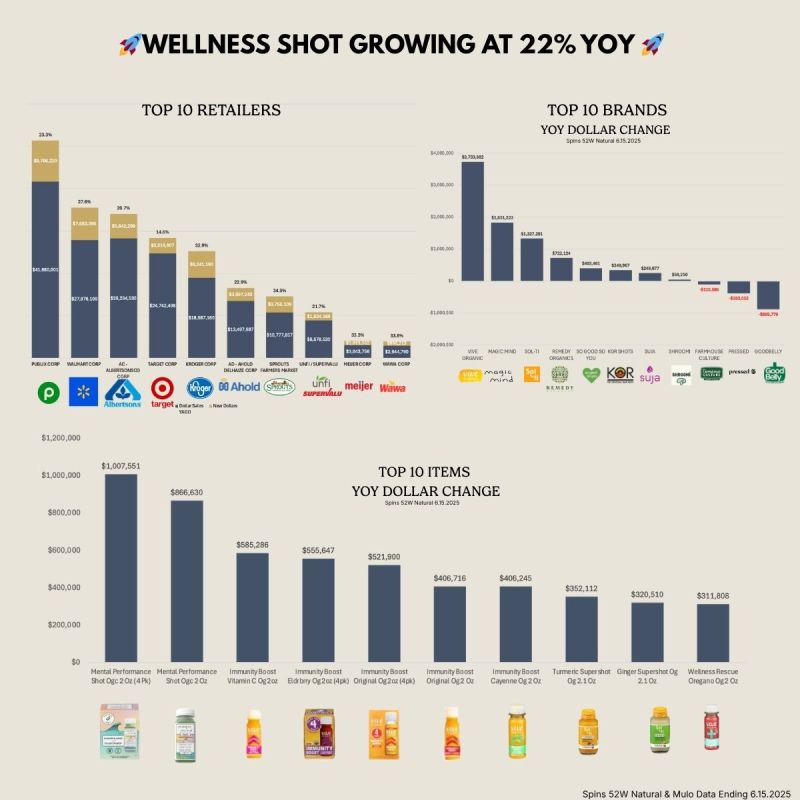

That’s the story emerging from the wellness aisle this July, as functional “health shots”—2oz drinks targeting energy, immunity, focus, gut health, and relaxation—shift from niche novelty to mainstream habit. New data shows functional shots are compounding at +22% YoY in the Natural Channel, blowing past total grocery growth rates and pulling double-digit gains at retailers like Sprouts (+34%), Walmart (+27%), Publix (+23%), and Wawa (+33%) (Matt Clifford, LinkedIn).

For DTC operators, it’s a signal worth zooming in on. These shots aren’t just selling in stores—they’re quietly becoming one of the most promising omnichannel formats in wellness. Brands like Magic Mind and Vive Organic are leading the charge, and their success is rewriting what a Shopify-first wellness brand can look like in 2025.

The functional flywheel: convenience, culture, and content

What’s powering the rise of wellness shots? A collision of three forces:

- Convenience-as-benefit: Consumers are leaning harder into quick, no-prep health formats. A 2025 survey shows Millennials and Gen Z are prioritizing gut health, brain clarity, and daily recovery—and want those benefits in portable, drinkable form (PR Newswire).

- #Wellness virality: TikTok’s #guthealth has clocked over 2.2B views (Stylist), turning morning shot rituals into creator currency. Ginger and matcha elixirs aren’t just health products—they’re shareable lifestyle markers.

- Checkout discovery: With shots often placed in fridges near checkout, brands are capitalizing on low-friction trial. That impulse purchase becomes sticky if the effects feel real—even if it starts with “why not?”

To ground the performance surge in hard numbers, here’s how the category is growing across top retail channels:

| Retailer | Functional Shot Sales Growth (YoY) |

|---|---|

| Sprouts | +34% |

| Walmart | +27% |

| Publix | +23% |

| Wawa | +33% |

| Natural Grocery Avg. | +22% |

Source: Matt Clifford, LinkedIn

As DTC brand strategist Cara Comp put it, these “fast-function formats are meeting consumer demand for convenience, clean ingredients, and real results” (LinkedIn). When your format is tiny, potent, and photogenic, the conversion funnel shortens—whether it starts on TikTok or in a Sprouts fridge.

What people are actually buying: focus and immunity lead the way

Two use-cases are driving the bulk of DTC demand:

- Energy & focus: Magic Mind’s nootropic productivity shot—a matcha and adaptogen blend with 55mg caffeine—has grown into a full-blown ritual for knowledge workers. The brand claims 30K+ active subscribers and recently expanded into 400+ retail doors, including Sprouts (Magic Mind).

- Immunity: Ginger, turmeric, citrus, and probiotic shots from brands like Vive Organic, KOR, and So Good So You continue to drive volume—especially post-COVID. As co-founder Rita Katona put it, SGSY has pushed beyond immunity to cover “detox, beauty, energy, and even mental health,” which helped fuel +65% YoY growth (Organic Produce Network).

To get a clearer sense of how product innovation is diversifying across use-cases, here’s a simplified breakdown:

| Functional Use Case | Leading Brands | Key Ingredients |

|---|---|---|

| Energy / Focus | Magic Mind | Matcha, adaptogens, B-vitamins |

| Immunity | Vive, SGSY, KOR | Ginger, turmeric, citrus, probiotics |

| Digestion / Gut | So Good So You, Sol-ti | Probiotics, prebiotics |

| Relaxation / Sleep | Magic Mind (Sleep) | L-theanine, adaptogens, magnesium |

| Beauty / Detox | KOR, SGSY | Charcoal, collagen, biotin |

Across the category, energy/focus and immunity remain the top sellers, but the success of newer concepts suggests consumers are open to many “functional” promises in a convenient format.

The DTC edge: speed, specificity, and story

This category didn’t start in a Pepsi lab. It started with scrappy, Shopify-native brands.

Founders in the DTC space saw the whitespace: consumers wanted concentrated wellness without the sugar bloat or bodega branding of legacy shots. Magic Mind built a community of biohackers and creators through content and podcast ads. Vive scaled from wellness cafés to DTC to Sprouts by owning the immunity positioning early.

Big Beverage is starting to circle. Suja’s 2021 acquisition of Vive Organic is now seen as a savvy early bet (Forbes). And insiders expect copycat products—or outright acquisitions—from Coke and Pepsi once the format’s mass potential is fully unlocked.

But the most effective brands are those building an ecosystem—not just a SKU. Magic Mind’s founder William Hicks said it best: “This isn’t your typical sugar and caffeine boost. It’s a carefully crafted formulation designed to enhance cognitive function in an innovative, health-conscious way” (Business Wire).

That founder-first narrative, backed by real ingredients and use-case specificity, is what gives DTC brands a defensible edge.

Is it sticky—or just snackable?

Functional shots are growing. But will they stick?

Early signs are promising:

- Magic Mind’s 30K+ subscribers suggest repeat use, not just novelty (Magic Mind)

- SGSY’s high repeat rate helped it secure a $14.5M raise from Prelude (Prelude Growth)

But there are real hurdles:

- Perceived value: At $3–5 for 2oz, price-to-benefit ratio has to be crystal clear.

- Efficacy scrutiny: As the space grows, so does the need for education. Are the ingredients legit? Do people feel a difference?

- Logistics: Many shots require cold chain logistics, shortening shelf life and complicating DTC shipping.

The brands that win will be the ones who answer: why this shot, why now, and why again?

This is where tools like LiveRecover fit in. When a subscriber misses a shot delivery or bounces mid-checkout, a human-powered SMS nudge can restore trust, answer questions, or reinforce routine. It’s not just about recovering revenue—it’s about reinforcing habit.

Functional shots = fast wellness. But fast doesn’t mean fleeting.

The global functional shot market is projected to grow from $0.9B in 2025 to $1.7B+ by 2029 (TBRC). This isn’t a short-term TikTok fad. It’s a signal.

DTC brands should take note:

- If you’re in wellness, shots might be a product line worth testing—especially if you’ve already built community trust.

- If you’re adjacent (beverage, supplements, CPG), watch how these brands use education, routine, and omnichannel to scale.

- And if you’re in operations, this is a case study in how small-format CPG can drive velocity, not just margin.

Functional shots are proof that consumers will pay for compact, targeted, repeatable solutions. The brands that win won’t just sell shots—they’ll sell stories, rituals, and results.

Subscribe for weekly DTC insights.