The fastest-growing DTC brands in 2025 aren’t just raising—they’re compounding. They’re scaling with sticky products, cult communities, and omnichannel plays that don’t rely on brute-force ad spend.

This page is updated quarterly with brand-level breakdowns, verified numbers, and strategy takeaways for real operators—not just headline chasers.

Fastest Growing DTC Brands in 2025

Track the breakout brands posting real growth—not hype. We update this list quarterly with fresh data, operator insights, and retail expansion milestones.

SubscribeDirect-to-consumer growth looks different in 2025.

It’s not about who raised the biggest round. It’s not about CAC-chasing vanity metrics. The fastest-growing DTC brands this year are scaling with focus—building products people actually want, layering in omnichannel reach, and doubling down on operational discipline.

For a breakdown of the traits these brands share—and the common traps that stall others—see our companion analysis:

What Qualifies as “Fastest Growing”?

To make this list, a brand must meet at least two of the following:

- $50M–$1B in projected 2025 revenue

- Double-digit YoY growth (quarterly or trailing twelve)

- Expanded omnichannel footprint (retail, Amazon, wholesale, DTC)

- Cultural relevance (viral UGC, creator/influencer backing, or standout loyalty)

Feastables

Category: Food & Beverage

Estimated 2025 Revenue: $520M (projected)

12-Month Growth: Tripled revenue since 2022

Launched by MrBeast in 2022, Feastables has scaled from a YouTube-fueled product drop to a full-blown CPG juggernaut. It posted $251M in 2024 revenue with over $20M in profit—and is projected to cross $500M in 2025 (What's Trending).

In Q2 2025, the brand became OU Kosher certified—opening up new customer segments and reinforcing its clean-label, better-for-you positioning (PR Newswire).

Feastables began as a Shopify-native DTC brand but now spans Walmart, Target, 7-Eleven, and Amazon. Every launch is gamified—limited SKUs, influencer-led stunts, community giveaways. MrBeast himself called his strategy “reinvesting everything to the point of stupidity”—a long-term bet that’s clearly paying off.

Operator Ashvin Melwani called Feastables one of the clearest examples of how top-tier DTC growth systems are built today:

“Between Obvi and Feastables, these systems have driven over $200M in revenue” (Ashvin Melwani on X).

What got Obvi to $100M in lifetime revenue would bankrupt most brands today.

— Ash (@ashvinmelwani) July 21, 2025

The DTC playbook has completely flipped. Strategies that worked 2 years ago are now lighting cash on fire.

When we first scaled Obvi, we focused almost entirely on acquisition. Pouring money into Meta,…

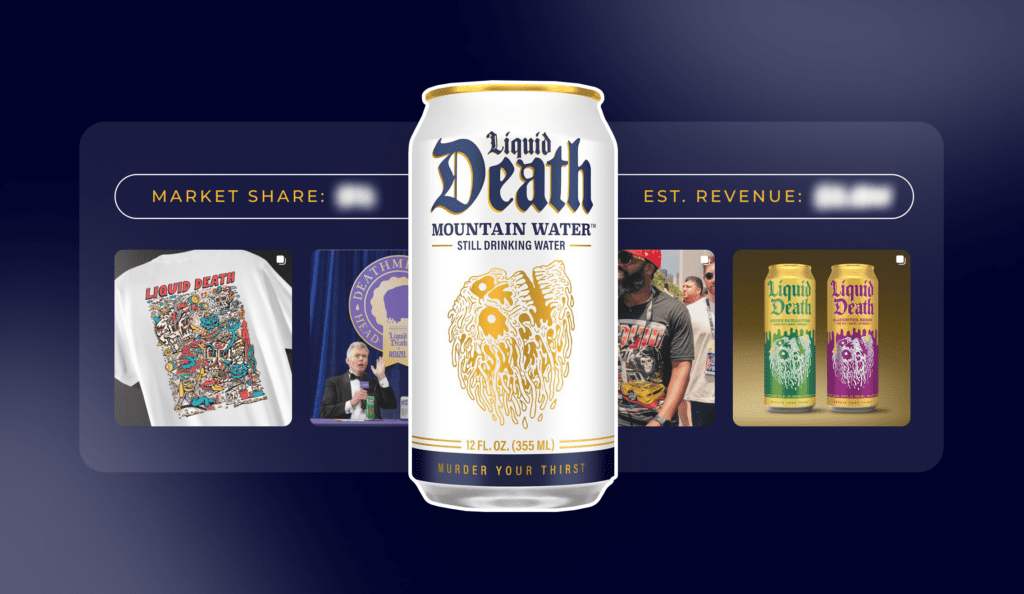

Liquid Death

Category: Beverage

Estimated 2025 Revenue: $340M

Retail Presence: 133,000+ doors

Funding to Date: $250M+

Liquid Death made water loud. And profitable.

The brand’s 2024 retail sales surpassed $300M, with 2025 revenue projected at $340M (Sacra, MicroVentures).

In July 2025, they launched Sparkling Energy—a better-for-you entry into the $23B energy drink market (Food Dive).

The energy launch caught serious attention across the industry.

“Liquid Death is dropping an energy drink—but it’s more chill than killer,” said CEO Mike Cessario in a July post (Gymfluencers).

Liquid Death is dropping an energy drink — but it’s more chill than killer. ⚡️

— Gymfluencers (@Gymfluencers1) July 21, 2025

Think a cup of coffee, not a dry scoop of pre-workout, says CEO Mike Cessario.

Here’s the lowdown. 👇https://t.co/BQSipgViOj

Beyond that, Liquid Death is omnipresent: Whole Foods, Walmart, music festivals (via Live Nation sponsorships), and viral collabs. The brand’s growth engine is built on absurdist marketing—skateboards infused with Tony Hawk’s blood, death-metal merch drops—and a product that fits modern values (aluminum cans, low sugar, high taste).

Founder Mike Cessario’s mantra? “What’s the dumbest idea we could do?” It’s turned into a $1.4B beverage empire (Jungle Scout).

Athletic Brewing Co.

Category: Non-Alcoholic Beer

Estimated 2025 Revenue: Nine figures

Top Craft Brewer Ranking: #8 in the U.S. (by volume)

Athletic Brewing is proof that NA beer isn’t niche—it’s category-defining.

As of April 2025, Athletic ranked #8 in U.S. craft breweries by volume—making it the highest-ranked NA brand ever (Craft Brewing Business).

With support from General Atlantic, Athletic is doubling capacity with a new 750,000-barrel brewery in San Diego (InsideHook).

Its channel mix is tight: DTC subscriptions, seasonal drops, Whole Foods, Total Wine, Emirates Stadium (via Arsenal FC partnership), and direct sales at gyms and races.

The product promise—great-tasting beer with <0.5% ABV—has tapped a massive sober-curious and performance-focused audience. Founder Bill Shufelt says their north star is long-term quality and community. It shows.

Athletic’s momentum reflects more than just timing.

“Gen Z ditched alcohol, so guess what’s trending now,” (@diabyismael).

Genz ditched drinking Alcohol, so guess what's trending now.

— Ismael Diaby (@diabyismael) July 22, 2025

Non alcoholic beverages. Perfect timing to launch one.

Athletic Brewing just raised $50 million at a $800 million valuation. For non-alcoholic beer!

Here is a winning product: Kombucha Sparkling!

Test offer, then… pic.twitter.com/8CawVsGepc

Olipop

Category: Functional Soda

Estimated 2025 Revenue: $400M

Valuation: $1.85B

Olipop owns 60% of the global prebiotic soda category—and they’re still in growth mode (TapTwice).

In 2024, revenue doubled from $200M to $400M. This year, they’ve launched nostalgia-flavored SKUs (Dr. Goodwin, Banana Cream), expanded into 50,000+ stores, and launched a viral #OlipopChallenge on TikTok (Just Drinks).

Olipop’s playbook is textbook DTC crossover: high-retention DTC subscribers, high-velocity retail, and clean storytelling on TikTok and Instagram. It tastes like soda but includes prebiotics, fiber, and under 5g of sugar—unlocking trial from both wellness customers and soda diehards.

Co-founder Ben Goodwin puts it best: “We’re not here to be a niche health drink—we’re here to redefine soda” (Inc.).

The brand’s performance continues to spark conversation.

“Olipop did $400M in 2024, valued at $1.85B,” shared one analyst (@pitdesi).

Liquid death hoping to do $340M in revenue this year, up 40% YoY. Last round at $1.4B.

— Sheel Mohnot (@pitdesi) June 18, 2025

Poppi did ~$500M in 2024, bought for $1.95B by Pepsi

Olipop did $400M in 2024, valued at $1.85B pic.twitter.com/1F4oXsIJkR

Skims

Category: Apparel

Estimated 2025 Revenue: $750M–$1B

Valuation: $4B

Retail Moves: Flagships in LA and NYC, global pop-ups

Skims is a cultural engine disguised as an underwear brand.

Launched in 2019 by Kim Kardashian and Jens Grede, the brand quintupled revenue in three years, hitting $713M in 2023 (Inc.). It’s pacing toward $1B with profitability and a waitlist for nearly every drop.

While many brands scale back retail, Skims is doing the opposite.

“Kim just opened up multiple brick & mortar locations for SKIMS—in the era of everything going digital,” noted one operator (@djtavv).

You talking about trends. This is what I’m saying. Kim just opened up multiple brick & mortar location for SKIMS in the US in the era of everything is digital.

— TAVV (@djtavv) July 21, 2025

Would you rather be underpaid or overrated/irrelevant? I’m not choosing underpaid. LMAOOOOOO

In Q2 2025, Skims launched new product lines (bridal, menswear), expanded internationally (London, Tokyo), and hit wholesale shelves via Nordstrom and Saks (Los Angeles Times).

The brand’s drops create Supreme-level urgency, while its core basics drive long-term retention. With a $20–$100 AOV and DTC at its core, Skims now blends hype culture with strong LTV.

Grede says they’re building a “forever brand.” With a $4B valuation and IPO buzz circling, it’s working.

Phlur

Category: Fragrance

Estimated 2025 Revenue: $150M+

Acquired: July 2025 by TSG Consumer Partners

Phlur is the TikTok fragrance brand that did what legacy houses couldn’t: made scent emotional—and viral.

Its signature product, “Missing Person,” turned into a Gen Z phenomenon, with hundreds of TikTok reviews capturing users crying over how “familiar” the scent felt (Business of Fashion).

The brand saw 65% YoY growth in 2025 and became Sephora’s #2 fastest-growing fragrance brand. In July, TSG Consumer Partners acquired Phlur for an undisclosed sum. Chriselle Lim remains on as creative director.

Their mix? Accessible prestige pricing, minimalist packaging, story-driven launches, and product variety (deodorant, candles, mists). DTC is still ~50% of sales.

Lim summed it up: “Phlur isn’t just a product—it’s a feeling.” The market agrees.

The acquisition was picked up across X and industry press:

“TSG Consumer Partners Acquires Phlur Amid Surge in Influencer-Backed Fragrance Brands” (@globalcosmetics).

News Alert

— Global Cosmetics News (@globalcosmetics) July 24, 2025

TSG Consumer Partners Acquires Phlur Amid Surge in Influencer-Backed Fragrance Brands

Continue to read for free on @globalcosmeticshttps://t.co/5B3JgVSSqm

Grüns

Category: Vitamins & Wellness

Estimated 2025 Revenue: $100M+

Retail: Sprouts, Target, Walmart, Amazon

Valuation: $500M

Grüns has gone from TikTok darling to retail powerhouse in under two years.

The green gummy vitamin brand surpassed a nine-figure revenue run rate in 2025—shipping over 4 million gummies per day (Modern Retail). It hit profitability just 14 months after launch (Inc.).

Retail rollout has been aggressive: Sprouts, Target, and Walmart shelf space plus a best-selling Amazon presence. Early results were strong—Sprouts sales “exceeded expectations,” and Walmart expansion began in Q2 (Pati Group).

Grüns now has over 250,000 subscribers and 20,000+ reviews (4.8★ average). New product lines like Grüns Cubs (for kids) and Nütrops (nootropic-infused) are fueling LTV. Celebrity backers include Joe Burrow and Anna Kendrick. A new SKU is slated for Q3 2025.

Much of Grüns’ velocity is social-first. TikTok flash sales, creator-driven launches, and influencer moments with Bethenny Frankel and Jessie James Decker have kept the buzz high. It’s a retention machine wrapped in a gummy bear—and it’s working.

David Protein

Category: Nutrition

Estimated 2025 Revenue: $100M+ (first 12 months)

Retail: 5,000+ U.S. stores

Valuation: $725M+

David isn’t just growing fast—it’s warping the growth curve.

Founded by RxBar’s Peter Rahal, the brand crossed $1M in week-one sales, raised $75M by Q2, and is on pace for $100M+ in year-one revenue (Athletech News). Valuation? $725M by mid-2025 (Inc.; LinkedIn).

The bars themselves are objectively insane: 28g protein, 0g sugar, 150 calories. David even acquired its ingredient supplier (Epogee) for exclusivity—a move so bold that rivals filed antitrust complaints.

In just months, David hit 5,000+ retail doors and built a die-hard fanbase through biohacker pods, X threads, and memes. The viral “boiled cod” stunt—where they actually sold boxes of frozen fish—spiked engagement 14,000% and positioned the brand as both performance-first and culturally self-aware (Inc.).

Backed by Dr. Andrew Huberman and Dr. Peter Attia, David blends science, humor, and velocity in a way that’s redefining the protein bar category.

Want next quarter’s breakdown before anyone else? Subscribe for weekly DTC insights.