CAC vs LTV: What 2025 Data Says About Retention ROI

The New Rules: CAC and LTV in a Changed DTC Landscape

We’ve all seen the shift—DTC brands are no longer cruising on the back of cheap digital ads. The 2025 landscape demands a fresh playbook, with rising ad costs and privacy crackdowns reshaping how we think about the CAC vs LTV equation (Common Thread Collective).

For mid-size Shopify brands, especially those beyond the drop-shipping phase and building real equity, the message is clear: sustainable growth hinges on retention and LTV, not acquisition at any cost. As DataDrew notes, brands winning in 2025 are those not just acquiring customers, but keeping them (DataDrew).

Why does this matter? Well, when you can drive more revenue from each customer, you can afford to spend more upfront—even as acquisition costs soar. The traditional LTV:CAC “gold standard” ratio of 3:1 has become elusive, with many brands stuck at 2:1 or less. It’s a sign that acquisition-focused strategies are faltering (DataDrew). The solution? Double down on retention ROI.

The CAC Squeeze: Why Acquisition Alone Won’t Cut It

Let’s face it: digital ad costs have skyrocketed. CAC is up 60% in just three years (Reema Singhal). Meta and Google are less growth engines and more pay-to-play toll booths (100xElevate). As Common Thread Collective puts it, “skyrocketing acquisition costs” have wiped out entire e-commerce cohorts (Common Thread Collective).

Brands are scrambling to adapt, with CAC and AOV now at the top of the CMO’s dashboard (Digiday). The math is straightforward: if you’re spending $100 to acquire a customer who spends only $50, your growth engine is faltering.

Experimenting with diversified spend and influencer marketing is happening, but the most effective strategy is clear: focus on retention. As New Engen emphasizes, 2025 is about “performance at the right cost,” not just growth at any cost (New Engen).

Operator insight: One DTC founder said it best: “Customer acquisition costs keep climbing, so every new buyer needs to be maximized. We realized we had to focus on LTV—increasing repeat sales, subscription uptake, and AOV—or we’d never break even on ad spend” (Reema Singhal; DataDrew).

Retention ROI: The Most Reliable Growth Lever in 2025

The numbers speak loudly: repeat customers spend 67% more than first-timers (100xElevate). Even a 5% boost in retention can increase profits by up to 95% (100xElevate). That’s why retention marketing is finally getting budget parity with acquisition.

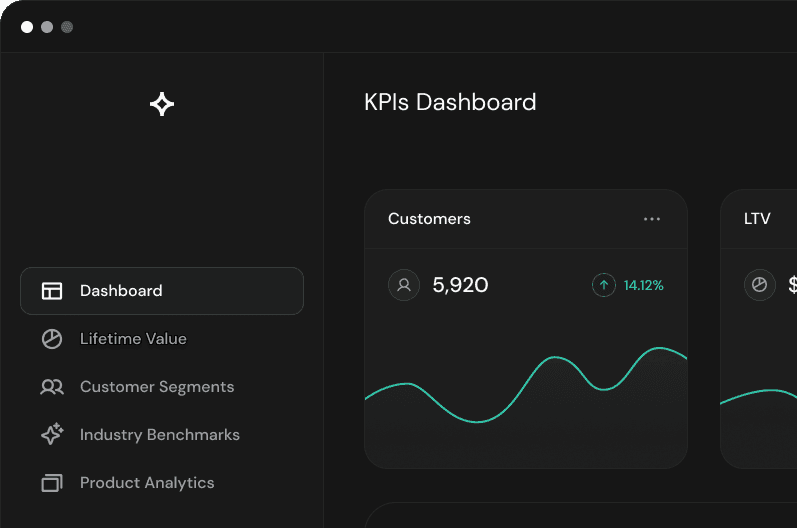

Here's a look at what healthy LTV:CAC ratios mean in the real world (DataDrew):

- Struggling brands: 1.5:1 to 2:1 (money-losing, VC-dependent)

- Average performers: ~2.5:1 (break-even, limited growth)

- Top-tier brands: 4:1 to 5:1 (profitable, reinvesting in scale)

Exceeding a 4:1 ratio likely indicates a strong retention strategy—subscriptions, vibrant communities, and sticky products. However, a ratio over 5:1 might suggest under-investment in growth (DataDrew).

Cash flow is crucial. Faster repeat purchases mean a quicker return on CAC. As Drew Fallon notes, a 3.0x LTV:CAC over 36 months is less appealing than a 2.0x achieved on the first purchase—the payback period is now a critical metric (ThreadReader).

Data Benchmarks: What’s “Good” Retention in 2025?

Here’s where the DTC retention benchmarks are setting in 2025 (DataDrew):

- Beauty & Cosmetics: ~35% repeat within 90 days—subscriptions and loyalty perks drive success.

- Apparel & Fashion: ~28% repeat, 18-month average lifespan—personalization and broader SKUs boost value.

- Health & Wellness: ~42% subscription retention after 6 months—subscriptions are key for LTV.

- Home & Garden: ~31% repeat—seasonality and replenishment fuel behavior.

The pivotal question for operators: What percentage of your revenue is from repeat customers? In 2025, thriving Shopify brands report 30–45% (or more) of revenue from “owned” retention channels like email, SMS, and direct reactivation (Reema Singhal). This is revenue that doesn’t require a fresh CAC investment in Google or Meta.

Retention isn’t just about loyalty—it’s a CAC reducer. Robust win-back and reactivation flows can reduce blended CAC by 20–30% (Reema Singhal). It’s straightforward: reactivating a lapsed customer is cheaper than acquiring a new one.

And let’s not forget customer experience (CX). Fast shipping, real support, and proactive outreach are essential. As retention expert Eli Weiss reminds us: “Your CX team often holds the key to keeping the lights on when things go wrong.” A single friction point can destroy years of loyalty. Invest wisely.

Operator Playbook: Retention-Driven Strategies That Move the Needle

What’s actually working for retention ROI in 2025? Among leading Shopify DTC brands, some strategies are becoming must-haves:

Loyalty and VIP Tiers:

Modern loyalty programs focus on exclusivity, not punch cards. High-LTV customers crave early access, surprise gifts, and community status (Reema Singhal). These VIPs drive significant revenue and referrals, further lowering effective CAC.

Personalized Email & SMS:

Owned channels are golden when used correctly. Brands are refining segmentation and timing, utilizing AI-driven recommendations and behavioral triggers to encourage repeat purchases. The best flows feel personal and arrive at the moment of intent, tipping a second purchase with no extra ad spend.

Subscription & Membership Models:

Turning your product into a “set and forget” model is the ultimate retention metric. Acquire once, bill repeatedly. Even non-traditional categories are embracing this model, like fashion rental and equipment with consumables. Low churn equates to high LTV.

Community & Content:

Transactional loyalty is fragile; emotional loyalty is sticky. Brands seeing exceptional retention are investing in content, education, and genuine community. Whether it’s a fitness brand’s members-only forum or VIP events, these touchpoints turn buyers into believers (DataDrew).

Human-Powered Recovery Flows:

Automation has limits, particularly in recovering abandoned carts. That’s why operators are adding LiveRecover to their toolkit—deploying real human agents to text shoppers who’ve abandoned carts, address objections, and close sales in real time. The result? Higher revenue recovery and a better brand experience. Unlike standard bot-driven flows, LiveRecover engages customers with a personal touch, preserving trust and nudging potential buyers to convert. In a world where every conversion counts, blending automation with a human touch provides a competitive edge.

From Metric to Mindset: Retention as the Core DTC Play

The biggest shift in 2025 isn’t about a new tactic—it’s embracing a new mindset. Retention is no longer an afterthought but central to how leading DTC brands operate. As one Shopify-focused report states,

“If you are spending on ads but not investing in retention, you’re building a leaky funnel” (100xElevate).

Growth is about more repeat buyers, not just more traffic.

This doesn’t mean acquisition is dead. It means acquisition and retention must work together, each optimizing the other. The most resilient brands are tuning their acquisition channels for efficiency while pulling every retention lever to extract maximum value from each customer.

The payoff? Stronger margins, sustainable growth, and a P&L that can withstand volatility. Turning that $50 first sale into $200+ in LTV over 12–18 months isn’t just a nice-to-have—it’s the difference between surviving and thriving (Reema Singhal). Achieving a 20% CAC reduction now demands relentless focus on retention (Retail Online Daily). This isn’t about email open rates or gamified points—it’s about fundamentally improving your brand’s economics.

The Bottom Line: Retention ROI Is the Founder’s Advantage

As 2025 winds down, one thing is clear: founders who master the CAC vs LTV balance will lead the next era of DTC. Cheap acquisition is gone; smart retention is the new growth engine. Operator conversations have shifted from obsessing over CPAs to comparing repeat purchase rates, subscription stickiness, and LTV:CAC. The real question is: What’s your retention strategy, and how is it impacting your growth?

Because at the end of the day, the real ROI is in retention—turning first-time buyers into loyalists and making every acquisition dollar count for more.

Subscribe for weekly DTC insights.